How Many Coal Bankruptcies Will Result From Obama’s War on Coal

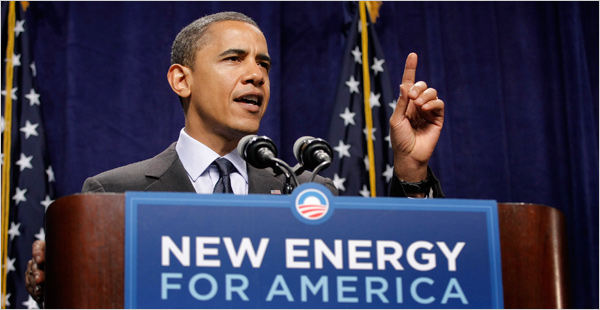

It’s no secret that coal company stocks are taking a beating from President Obama’s war on coal.

Over the past few years, coal stocks are down more than seventy-five percent and during the same period Patriot Coal and James River Coal Company filed for bankruptcy.

The regulatory climate is going to get worse with news breaking that President Obama is going to announce a new set of EPA regulations that are going to target greenhouse gas emissions from existing power plants.

The Pittsburgh Post-Gazette wrote about the implications of the new rule in Pennsylvania.

On June 2, the U.S. Environmental Protection Agency is expected to release guidelines aimed at cutting carbon emissions from existing power plants. The new rules could have powerful implications in Pennsylvania, one of the country’s top electricity producers and sources for fuels like natural gas and coal.

With coal stocks so low some are thinking it might be a good time to buy. However, an article in Barron’s says stock pickers should consider the likelihood of more bankruptcies.

Pick a coal stock–any coal stock–and it’s likely that those shares have been pounded this year. That’s made some analysts consider whether they’re cheap enough to buy. UBS thinks its time to consider bankruptcy, even if its not a near-term concern.

The devastating consequences from Obama’s war on coal continues to mount and it looks like it’s going to get much worse.