Taxpayers are Paying $39 Billion to Finance Other People’s Student Loans

No college degree? No problem! American taxpayers can still play a role in the “student debt experience” by funneling their tax dollars into federal programs that tie student debt obligations to income.

Laura Strong, a 29-year-old in suburban Chicago, owes $245,000 on student loans for the psychology Ph.D. she finished in 2013. This year, she says she hopes to earn $35,000 working part-time jobs as a therapist and yoga teacher—not enough to manage a loan payment of about $2,000 a month. But Strong isn’t paying anything close to that. She’s one of at least 3.8 million Americans who’ve qualified for federal programs that tie payments to income and eventually forgive debt for some struggling borrowers, leaving taxpayers to pick up the tab.

President Obama has praised the programs for offering a lifeline to borrowers who’d otherwise default, scarring their credit. Strong pays about $100 a month on her federal loans, which she used to finance her graduate studies at Argosy University, a for-profit institution. “I wouldn’t know how I would pay it back otherwise,” she says.

Income-based repayment was introduced under President Clinton, but the programs weren’t heavily promoted until late 2013, when the Obama administration began sending e-mails to borrowers, including Strong, telling them, “Your initial payment could be as low as $0 a month.” The number of people using these plans has quadrupled since 2012.

… In a July 27 speech at the University of Maryland’s Baltimore campus, Secretary of Education Arne Duncan said the plans protect people going into socially valuable but low-paying lines of work from crushing debt. “That’s good for them. That’s good for our economy. It’s good for our society,” he said.

…The Congressional Budget Office estimates that, for loans originated in 2015 or after, the programs will cost the government an additional $39 billion over the next decade. That’s more than the agency spends each year on Pell grants, the public scholarship program for low-income students.

There are so many things wrong with this picture. Much like the tax code, the federal government is using student loan debt forgiveness as a social engineering tool to incentivize students to work in (what they consider to be) “socially valuable” fields of employment.

In addition, rather than encouraging colleges and universities to lower the costs of education, government is playing a lead role in distorting the market and artificially inflating tuition prices. Their loan forgiveness programs serve as an indirect subsidy to schools. Of course, for schools advertising to prospective students, government loan forgiveness is a feature of education costs, not a bug.

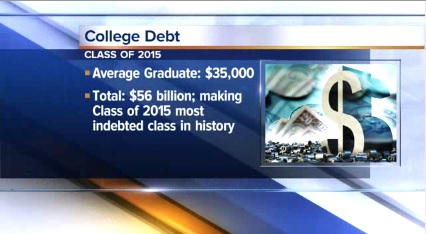

The average graduate is leaving college in 2015 with about $35,000 in student debt, totaling $56 billion. This is the most indebted graduating class in U.S. history. The federal government needs to stop burying their heads in the sand and to stop enabling institutions to raise tuition costs each year.